Motoring advice

-

AA Cars Used Car Checklist

-

Buying A Used Car

-

How To Haggle With A Dealer

-

10 Top Tips To Help Improve Your Car’s Fuel Economy

-

Spare Wheels: Using, Buying And Maintaining

-

Warranties

-

Car Documents: What Do You Need To Sell Your Car?

-

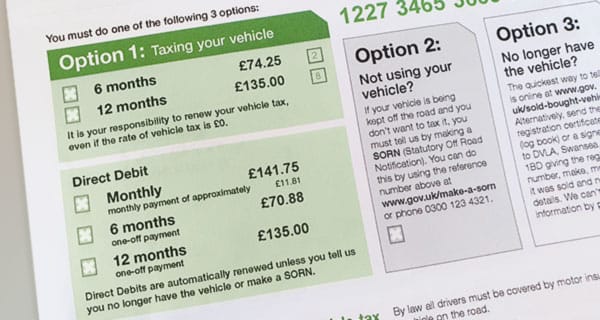

Car tax

-

Your legal rights