Best used family cars

The arrival of your first child is a momentous occasion, but when it does happen there are some questions which spring up. A key one is the type of car you’re going to drive when the baby does arrive.

The same goes for parents expecting a second, third or fourth child - how will you get them around safely, comfortably and - on occasions - quietly? That’s where your choice of car comes into play. Will you need a seven-seater or can a standard five-seater suffice? However, whereas many people think that you need a large SUV as soon as your first child arrives, there are plenty of smaller, more efficient models that can do the job, too.

Here, we’ve got 10 great used cars to check out, all of which feature Isofix points for the easy mounting of child seats.

Skoda Superb

Skoda has a great range of family-friendly models, but it’s the Superb which feels like it puts the greatest focus on being good for the whole clan. Available in both hatchback and estate forms, it’s got a genuinely enormous boot capable of swallowing up luggage, buggies and bikes without a moment’s hesitation.

Plus, with efficient engines on board, the Superb can do big distances without costing the earth. The rear doors open nice and wide, too, giving you easier access to the rear seats - a particularly handy feature when your hands are full!

Find a used Skoda Superb on AA CarsVolkswagen Polo

Superminis have grown in size and spaciousness in recent years. Take the latest Volkswagen Polo for example, which has been around since 2017 - it's nearly the same size as an early 2000s Volkswagen Golf from the class above.

With a large 351-litre boot, it's much bigger than the majority of cars in this class - easily providing enough room for a pram. Rear space is also generous, with a decent amount of legroom - handy when trying to prevent a small child from kicking the seat in front. The latest Polo is also a five-door only - aiding practicality. A 5-star safety rating from Euro NCAP (2017), and an 85% score child occupant protection makes it a great small family car.

Find a used Volkswagen Polo on AA CarsHonda Jazz

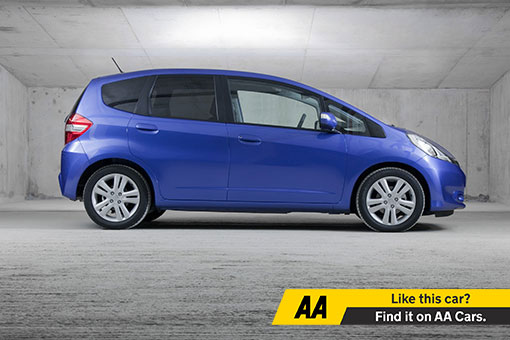

The Honda Jazz might not do your street cred any favours, but if you're looking for a seriously roomy and affordable small family car, this Japanese hatchback is a great option.

It's more of a small MPV than it is a supermini, and this works to its advantage- it has a large 354-litre boot and offers a serious amount of room in the rear seats. Even with 2 young children you won't struggle for room- plus, the space makes it easy to reach across when helping a child into their car seat. The third-generation Jazz (the most practical of the lot) also has a 5-star safety rating, including an 85% ranking for child occupant protection.

Find a used Honda Jazz on AA CarsCitroen C3 Aircross

Crossovers are becoming popular with the family car market- the additional ride height is a bonus when it comes to fitting child seats and getting kids out of them. While many of these vehicles look more practical than they actually are, the Citroen C3 Aircross isn't one of them.

This model has a 410-litre boot as standard, and comes with sliding rear seats that can increase the space on offer to 520 litres- significantly more than the 300 litres you get with the regular C3. The C3 Aircross also gets funky styling, and the all-important 5-star Euro NCAP safety rating- it was awarded a child occupant protection score of 82%, too.

Find a used Citroen C3 on AA CarsCitroen Grand C4 SpaceTourer

Though MPVs may have fallen out of favour with buyers lately, cars like the Citroen Grand C4 SpaceTourer show why this bodystyle still makes a solid case for itself when it comes to family car duties. Large, spacious and easy to access the Grand C4 SpaceTourer feels as though it was designed specifically with families in mind, while it also benefits from three ISOFIX points - handy if you’ve got a trio of little ones.

Its van-like shape means that the Grand C4 SpaceTourer gets a well-sized boot - even when the third row is in place - while hard-wearing plastics should ensure that this Citroen can easily cope with the hustle and bustle of family life.

Find a used Citroen Grand C4 SpaceTourer on AA CarsFord Puma

The Ford Puma is a great example of why you don’t need a huge car if you’re transporting a family. Despite its Fiesta-based underpinnings, the Puma is a small car which packs a lot of space, both in the cabin and also the boot. When it comes to the latter, a 90-litre ‘MegaBox’ of underfloor storage is seriously handy and it’s even got a drainage plug so you can use it for the storage of muddy boots or wellies after a winter walk.

Efficient engines ensure that the Puma won’t be too expensive to run and with nimble handling, it’s ideal for using to nip around town in.

Find a used Ford Puma on AA CarsVolvo V60

Volvo is a brand which has always had a keen ability to make rock-solid family cars and the V60 is a great example of this. It’s the smallest estate car that it offers - coming underneath the larger V90 in the range - but despite this, it’s got all of the space you could need thanks to its big, square boot that is very easy to access thanks to its low height and lack of loading lip.

Up front, the Volvo V60 incorporates some very comfortable seats and taller kids will be able to stretch out thanks to this car’s decent headroom levels. Because of the V60’s lower ride height you should find lowering child seats into the rear ISOFIX points a little easier than usual, too.

Find a used Volvo V60 on AA CarsToyota Yaris

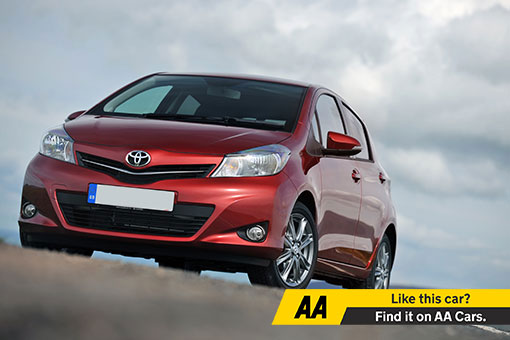

Though the Yaris might prove a bit small for some families, if you don't want anything too big, it could be a fantastic choice. Renowned for its reliability, the Yaris also has a great reputation for safety - with the latest example (launched in 2020) being one of the safest compact cars ever made, and still scoring an 81% rating for child protection.

This latest car also brings some big advancements in other areas, such as style and technology, while it's now exclusively sold as a hybrid - where Toyota claims it can return 68mpg, with CO2 emissions of just 92g/km. With a comprehensive list of standard equipment, it could be an ideal urban family runabout. Just be aware that the boot is relatively small.

Find a used Toyota Yaris on AA CarsRange Rover Evoque

Few brands have as much badge appeal as a Range Rover, and the British brand has been able to capitalise on this with the smaller Evoque. Though introduced in 2011, the second-generation 2019 car makes for a better option, thanks to its more modern interior and improved driving experience.

With plenty of standard equipment included, the Evoque - despite being the smallest Range Rover - is still practical, with a roomy interior and 591-litre boot making it a great choice for families that still want a car that's stylish. A wide range of petrol and diesel engines are offered, with an efficient plug-in hybrid recently joining the line-up. Euro NCAP awarded it an 87% child occupant protection score.

Find a used Range Rover Evoque on AA CarsSeat Leon

If you want a family car that still looks the part and is good to drive, a Seat model should be high on your shortlist, and particularly the brand's Leon. Based on a Volkswagen Golf, it offers a sportier design and impressive levels of technology - it was the first car in its class to come with full LED lights, for example.

Available as a hatchback or roomier ST estate version, both offer large boots, a generous level of standard equipment and an almost hot hatch-like feel from behind the wheel. Look out for a third-generation Leon (sold between 2013 and 2020), with these starting from just £4,000. A 92% child occupant protection score from Euro NCAP is seriously impressive too.

Find a used Seat Leon on AA CarsPrices correct at time of publication [11/2024].