Can I manage my account online?

Our lines are currently very busy and we're sorry for the inconvenience. Meanwhile, you can still use our online or automated services:

- Log into or register your account online, or download our Credit Card app from the Google Play or Apple App stores. Services include checking your balance, viewing transactions, PIN services and updating your contact details.

- Call our 24/7 automated phone self-service on 0345 600 5606 to check your balance, previous transactions and make a payment.

Payment breaks

Do you offer a payment break?

If you think you'll struggle to make your monthly credit card payments due to the coronavirus situation, you may be able to request a payment break.

Until 31 March 2021:

- If you haven't had a payment break before, you can request one for up to 3 months at a time.

- If you're currently on a payment break, you can request an extension for up to 3 months.

In total, you can have a break of up to 6 monthly payments to end no later than 31 July 2021. Call us on 0800 600 5606 to request a break.

After 31 March 2021:

- If you're already on a payment break you may be granted an extension for up to 3 months, to end no later than 31 July 2021.

- If your payment break has come to an end and you're still experiencing difficulties, call us on 0800 600 5606.

If you do take a payment break, we'll temporarily reduce your monthly credit card payment to just £1. However, you'll still be charged interest on the full balance for each month during the payment break.

The payment break won't impact your credit score.

While a break can help short-term problems with your cash flow, do consider if it's right for you. If you can afford to pay at least your contractual minimum payment, you should continue to do so. This will reduce the amount of interest you pay, and pay off the balance more quickly.

Am I eligible for a payment break?

At the moment, we're only offering a payment break if:

- You're up to date with your payments, or you've only missed your most recent payment.

- Your income has been impacted as a result of the coronavirus situation.

- You are the primary cardholder.

If you're already in arrears, or have financial difficulties that are likely to last more than 3 months, then a payment break might not be right for you. If this is the case, call us on 0345 600 5606 and we can discuss your circumstances.

What should I know before requesting a payment break?

- Only the primary cardholder can apply for a payment break - we can't accept applications from additional cardholders.

- The payment break is for a 3 month period. During this time we'll reduce your minimum payment to £1.

- You'll be charged interest on the full balance for each month during the payment break. Your monthly statement will show you the interest charged and estimated interest for the following month.

- By taking a payment break it'll cost you more to repay your balance. Your minimum payment will increase after the payment break due to the interest charged and any spend that has taken place during this period.

- At the end of the payment break, your monthly payment will go back to your contractual minimum payment. Your statement will show your minimum payment amount due when you need to pay it.

- During the payment break, you can carry on using your card up to your available credit limit.

- You can continue to make additional payments to reduce your balance if you want to during the payment break.

- If you usually pay by Direct Debit, we'll advise you of any changes required. Check your monthly statement too as this will confirm how much and when your Direct Debit will be taken.

- We won't report this payment break to credit reference agencies. However, lenders may obtain payment break information through other sources and take account of it in future lending decisions.

How much might a payment break cost?

During the payment break we'll reduce your minimum payment to £1. You'll be charged interest on the full balance for each month during the payment break so your balance will increase. As a result your minimum payment will go up once the payment break has ended.

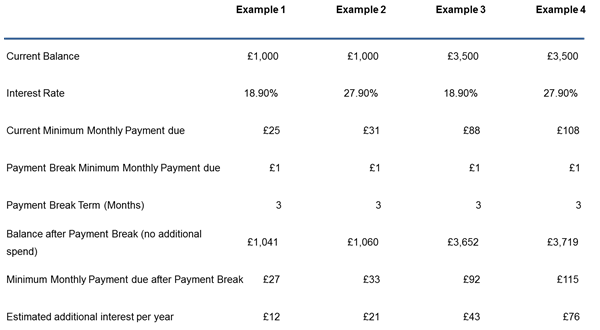

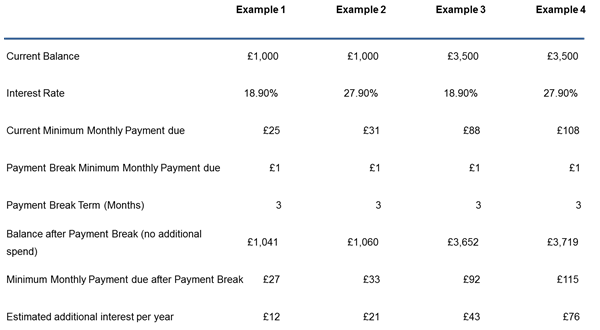

Examples of how much a payment break could cost are shown below:

- The figures used are for illustration only and don't show exactly what will happen to your account. The minimum payment in these examples is calculated as the maximum of £5, 2.5% of balance or 1% of balance plus interest.

- The examples above show how a 3 month payment break could impact the minimum payment due. They assume no additional spend on the account during the payment break - any additional spend will increase the balance and this will mean your minimum payment will be higher. If you had previously requested a 6-month payment break, the balance after the payment break and estimated additional interest per year will be different.

- The amount of interest charged to you during the payment break will depend on your balance, your interest rate, and the amount you spend on your card. This will also determine the minimum payment due when the payment break has ended.

- Estimated additional interest per year assumes minimum payments resume after the break period and no further spend on the account..

How will I know when my payment break is ending?

We'll contact you by email before your payment break ends. When it does end, your next statement will show your new contractual minimum payment, and when it's due to be paid.

What if I can't afford to pay my minimum payment once my payment break ends?

If you're worried that you won't be able to resume your minimum payment once your payment break ends, call us as soon as possible. If you don’t resume your payments, it will impact your credit file.

We'll ask about your everyday spending, so it will help to have details about your income and outgoings to hand.

Your income will include salary, any benefits and other income. Outgoings can include:

- Mortgage or rent

- Utility bills, such as gas, electricity, water

- Phone

- Food

- Clothing

- Insurance

- Credit card or loan payments

- Vehicle expenses, such as fuel, insurance, tax, maintenance

- Gym or sports membership

- Savings

If you want free, confidential and impartial advice about your finances, you can contact these organisations:

They will explain the different options available to you. If you're already in touch with an organisation that's giving you financial advice, tell us and we can deal with them directly.

The Financial Conduct Authority also provides consumer information and details of free sources of impartial financial help.

You should seek help that you feel best suits your circumstances.

Can I apply for a further payment break?

If you can resume your monthly payments, it's in your best interests to do so.

If you're currently on a payment break and you still have or are likely to experience short-term issues with your finances as a result of the coronavirus situation, you can apply for a further payment break for up to 3 months, which must end no later than 31 July 2021. In total, you can have a break of up to 6 monthly payments to end no later than 31 July 2021.

Remember that if you do apply for a further payment break the amount you owe will increase, because interest will continue to be charged on the outstanding balance and on any new spend.

Accordingly, your contractual minimum payments will increase once your payment break ends, so do consider if you can afford the increased payments.

We won't report to credit reference agencies that a payment break has been requested. But lenders may take into account other information when making future lending decisions, including information provided by you or bank account information.

A payment break isn't right for me but I'm still impacted by coronavirus

If you're concerned about your ability to repay your credit card, call us on 0345 600 5606 and we can discuss your circumstances.

For more help, the following organisations offer independent financial advice:

The Financial Conduct Authority also provides consumer information and details of free sources of impartial financial help.

Persistent debt update

If you received a letter from us saying your account is in persistent debt and you're concerned about paying your credit card, do call us on 0345 600 5606.